Introduction

In a significant monetary policy decision, the Reserve Bank of India (RBI) has reduced the repo rate by 50 basis points (bps) to 5.50% with immediate effect. This marks the third consecutive rate cut since February 2025, bringing the total reduction to 150 basis points in quick succession. The decision was announced following the 55th meeting of the Monetary Policy Committee (MPC) held from June 4 to 6, 2025, under the chairmanship of RBI Governor Shri Sanjay Malhotra.

This blog post analyzes the recent repo rate cut, its implications for the Indian economy, and the factors that influenced this monetary policy decision.

What is the Repo Rate and Why Does it Matter?

The repo rate is the interest rate at which the RBI lends money to commercial banks against government securities. It serves as a key monetary policy tool that influences borrowing costs across the economy. When the RBI reduces the repo rate:

- Banks can borrow funds at lower rates from the RBI

- This enables banks to reduce their lending rates to customers

- Lower interest rates stimulate borrowing and spending

- Increased consumption and investment can boost economic growth

Key Monetary Policy Changes

The MPC's decision has resulted in the following adjustments to key policy rates:

- Repo Rate: Reduced from 6.00% to 5.50% (↓ 50 bps)

- Standing Deposit Facility (SDF) Rate: Adjusted from 5.75% to 5.25% (↓ 50 bps)

- Marginal Standing Facility (MSF) Rate: Reduced from 6.25% to 5.75% (↓ 50 bps)

- Bank Rate: Reduced from 6.25% to 5.75% (↓ 50 bps)

Additionally, the MPC has changed its stance from "accommodative" to "neutral," signaling that future policy decisions will be data-dependent rather than following a predetermined path of rate cuts.

Rationale Behind the Rate Cut

The RBI's decision to cut the repo rate was driven by several key factors:

1. Significant Moderation in Inflation

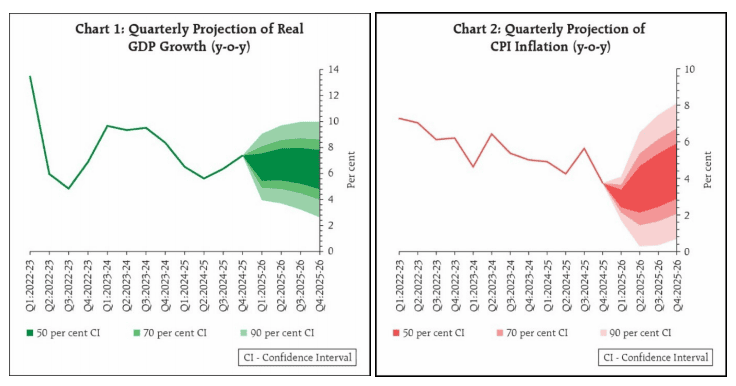

CPI Inflation and GDP : Actual and Projections (2025-26)

Inflation has softened considerably over the past six months, with headline CPI inflation moderating to a nearly six-year low of 3.2% in April 2025. This is well below the RBI's medium-term target of 4%. The central bank has revised its inflation outlook downward from 4.0% to 3.7% for the financial year 2025-26.

The moderation in inflation has been primarily led by:

- Six consecutive monthly declines in food inflation

- Benign core inflation despite increases in gold prices

- Favorable outlook for agricultural production with above-normal monsoon forecast

- Expected moderation in international commodity prices

2. Need to Support Economic Growth

While India's economic growth remains robust compared to global peers, the RBI noted that it remains "lower than our aspirations amidst challenging global environment and heightened uncertainty." The central bank emphasized the need to stimulate domestic private consumption and investment to step up growth momentum.

The RBI has maintained its GDP growth projection for 2025-26 at 6.5%, with quarterly variations:

Historical Repo Rate Trends (Select Periods)

Year | Repo Rate (%) |

April 2020 | 4.00 (COVID) |

Dec 2024 | 6.50 |

Feb 2025 | 6.25 |

April 2025 | 6.00 |

June 2025 | 5.50 |

3. Changed Growth-Inflation Dynamics

The RBI highlighted that the current macroeconomic environment presents a favorable opportunity for monetary policy easing:

- Durable alignment of headline inflation with the 4% target

- Expectation that inflation will undershoot the target during the year

- Soft food inflation outlook

- Benign core inflation with easing international commodity prices

Economic Indicators Supporting the Decision

Several economic indicators point to a resilient Indian economy that can benefit from monetary policy support:

Key Economic Indicators (April-May 2025)

Strong Agricultural Sector

- Combined kharif and rabi food-grains production at 354.0 million tonnes (6.5% higher than previous year)

- Above normal southwest monsoon forecast with early onset (8 days in advance)

- Healthy reservoir levels at 31.1% of full capacity (above last year's 22.5%)

- Record wheat procurement in the last four years

Robust Services and Manufacturing Activity

- Services PMI at 58.8 in May 2025, indicating strong expansion

- Manufacturing PMI at 57.6 in May 2025, well above the long-run average

- E-way bills increased by 23.4% in April 2025

- Gross GST collections rose by 16.4% in May 2025

Positive Trade Performance

- Merchandise exports recorded 9.2% growth in April 2025

- Non-oil exports grew at a healthy 10.3% in April 2025

- Services exports increased by 18.6% during March 2025

Global Context

The RBI's decision comes against a backdrop of global economic uncertainty:

- Global growth and trade projections have been revised downwards by multilateral agencies

- OECD revised down global growth forecast to 2.9% for 2025

- IMF lowered global growth projection to 2.8% for 2025 and 3.0% for 2026

- WTO projects world merchandise trade volume to contract by 0.2% in 2025

Despite these global headwinds, the RBI noted that "the Indian economy presents a picture of strength, stability, and opportunity" with strong balance sheets across major sectors - corporates, banks, households, government, and the external sector.

Future Monetary Policy Direction

After reducing the policy repo rate by 150 bps since February 2025, the RBI acknowledged that "monetary policy is left with very limited space to support growth." The change in stance from accommodative to neutral indicates that future policy decisions will be carefully calibrated based on incoming data and evolving economic conditions.

The MPC will focus on:

- Assessing incoming data and evolving outlook

- Striking the right growth-inflation balance

- Monitoring the fast-changing global economic situation

Implications for Various Stakeholders

For Borrowers

* Lower EMIs on existing floating-rate loans

* Reduced interest rates on new loans

* Potential boost for housing, auto, and personal loans

For Depositors

* Likely reduction in deposit rates

* Need to explore alternative investment options for better returns

For Businesses

* Lower cost of capital for expansion and investment

* Potential improvement in consumer demand

* Opportunity to refinance existing high-cost debt

For the Economy

* Stimulus for private consumption and investment

* Support for GDP growth amid global uncertainties

* Potential boost to sectors sensitive to interest rates like real estate and automobil

Conclusion

The RBI's decision to cut the repo rate by 50 basis points represents a significant monetary policy easing aimed at supporting economic growth while taking advantage of the favorable inflation outlook. The central bank's shift to a neutral stance suggests a more calibrated approach going forward, with policy decisions being guided by incoming data rather than a predetermined path.

As the effects of the cumulative 150 basis point reduction since February 2025 filter through the economy, stakeholders across sectors will need to adapt their financial strategies to the new interest rate environment. The coming months will be crucial in determining whether this monetary policy easing achieves its intended objective of stimulating growth without compromising price stability.